The vast expanse of Russia, with its frigid winters and abundant energy resources, has long been whispered about as a potential haven for Bitcoin mining. But whispers aren’t balance sheets. The question of profitability is a complex calculus, heavily influenced by fluctuating energy prices, evolving regulatory landscapes, and the ever-shifting difficulty of the Bitcoin network itself. Determining whether clinging to the digital gold rush in Russia still yields treasure requires a deeper dive beyond surface-level speculation.

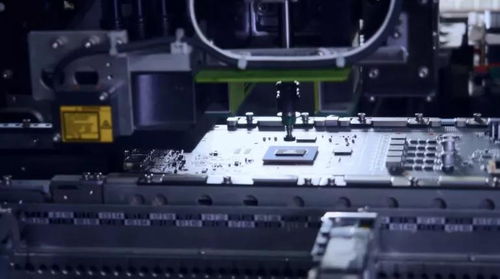

Initially, Russia seemed like a prime candidate. Cheap electricity, particularly in regions like Siberia, offered a tantalizing prospect. Mining farms sprang up, humming with the computational power needed to solve the complex cryptographic puzzles that underpin the Bitcoin blockchain. However, the allure of cheap power is often offset by other, less obvious expenses. Infrastructure costs, including cooling systems to combat the relentless heat generated by mining rigs, can be substantial. Moreover, the cost of importing and maintaining specialized mining hardware – Application-Specific Integrated Circuits (ASICs) – adds another layer of financial complexity.

Furthermore, geopolitical factors weigh heavily on the equation. Sanctions, international relations, and the ever-present threat of government intervention can drastically alter the profitability of Bitcoin mining in Russia. While the Russian government has flirted with the idea of embracing cryptocurrency mining, the regulatory framework remains somewhat ambiguous, adding a degree of uncertainty that deters some investors.

The profitability of mining any cryptocurrency, Bitcoin included, fundamentally boils down to a simple equation: revenue minus expenses. Revenue is determined by the number of Bitcoins mined, which is directly proportional to the hash rate of the mining operation and inversely proportional to the overall network difficulty. Expenses include electricity costs, hardware depreciation, maintenance, cooling, and potentially taxes or regulatory fees. If the revenue consistently exceeds expenses, the operation is profitable. But that’s a big “if.”

The price of Bitcoin itself is, of course, a crucial factor. A sudden price crash can render even the most efficient mining operations unprofitable overnight. Conversely, a sustained bull run can catapult even less efficient miners into profitability. This volatility makes Bitcoin mining a high-risk, high-reward venture.

Beyond Bitcoin, the landscape of cryptocurrency mining is far more expansive. Ethereum, with its transition to Proof-of-Stake (PoS), has largely sidelined traditional GPU mining, though the Ethereum Classic chain still offers some opportunities. Altcoins like Dogecoin, while often viewed as speculative assets, can also be mined, though their profitability is even more sensitive to market fluctuations and hashing algorithms.

The hosting of mining machines has emerged as a business model in itself. Companies provide infrastructure, security, and technical support to individuals or organizations that own mining hardware but lack the resources or expertise to operate it independently. This model allows miners to access cheaper electricity and better infrastructure without having to manage the day-to-day operations themselves. However, hosting fees can significantly impact overall profitability.

Looking ahead, the future of Bitcoin mining in Russia remains uncertain. Technological advancements, such as more energy-efficient ASICs, could lower operating costs. Changes in the regulatory environment could either encourage or stifle growth. And, of course, the ever-volatile price of Bitcoin will continue to exert a significant influence on profitability. A comprehensive cost analysis, taking into account all these factors, is essential for anyone considering entering or expanding their Bitcoin mining operations in Russia. The days of easy profits are long gone; success requires careful planning, efficient operations, and a keen understanding of the complex economic and political landscape.

Intriguing title! Explores Russian Bitcoin mining profitability amid fluctuating energy costs and geopolitical pressures. Uncovers surprising resilience, but regulatory uncertainty casts a long shadow. Viable, yet risky.